estate income tax return due date 2021

The Minnesota Department of Revenue must receive your return electronically or it must be. Personal income tax extensions must be filed on or before April.

.png?sfvrsn=10a6f687_3)

Iras Tax Season 2022 All You Need To Know

2020 to December 31 2021 subject to certain exceptions.

. IT-2664 Fill-in 2022 IT-2664-I Instructions Nonresident Cooperative Unit Estimated Income Tax Payment Form - valid for sales or transfers date of conveyance after December 31 2021. Income Tax Due Dates. Calendar year estates and trusts must file Form 1041 by April 18 2022.

Due date of return. The income deductions gains losses etc. Most people must file their 2021 Minnesota tax return by April 18 2022.

The income that is. Estate tax return preparers who prepare a return or claim for refund which reflects an understatement of tax liability due to willful or reckless conduct are subject to a penalty of. Payment due with return 07061 Payment on a proposed assessment 07064 Estimated payment 07066 Payment after the return was due and filed 07067 Payment with extension.

Due date of return. IR-2022-141 July 19 2022 The Internal Revenue Service is reminding the estimated 19 million taxpayers who requested an extension to file their 2021 tax return that. Form M706 Estate Tax Return and payment are due nine months after a decedents death.

We allow an automatic six-month extension to file but do not allow an extension for payment. If the section 645 election hasnt been made by the time the QRTs first income tax return would. 31 rows A six month extension is available if requested prior to the due date and the.

The official tax deadline set for filing your federal income tax return each year is April 15 but it can be flexible. The estate income tax return must be filed by April 15 2022 for a December 31 2021 year end or the 15th day of the fourth month after end of the fiscal year. 13 rows Only about one in twelve estate income tax returns are due on April 15.

The Tax Law requires a New York Qualified Terminable Interest Property QTIP election be made directly on a New York estate tax return for decedents dying on or after April 1 2019. Fiduciary Income Tax Return. This 2021 is Thursday but the deadline can sometimes be.

Due date for self assesment tax payment upto 1 lakh 15th February 2021 para 4 a para b The due date for self-assessment tax payment 10th January 2021 para 4 c. The fiduciary of a domestic decedents estate trust or bankruptcy estate files Form 1041 to report. The civil penalty for failing to file a return by the due date is 6 of the tax.

Due on or before April 19 2022 2021 Form 2. The filing extension must be requested on or before the statutory. Income Tax Return Form 770 if the estate or trust had.

10 rows Estate Tax Return for decedents dying after December 31 2020 and before January 1 2022. As the economic recovery continues from the impact of COVID-19 the New Hampshire Department of Revenue Administration NHDRA is offering low and moderate. Of the estate or trust.

Also to note that the Schedule K-1 should be properly filled if the trust has transferred an asset to a beneficiary and claimed a deduction for. 1 day agoAll tax refunds including the 62F refunds are taxable at the federal level only to the extent that an individual claimed itemized deductions on their fedreal return for tax year 2021.

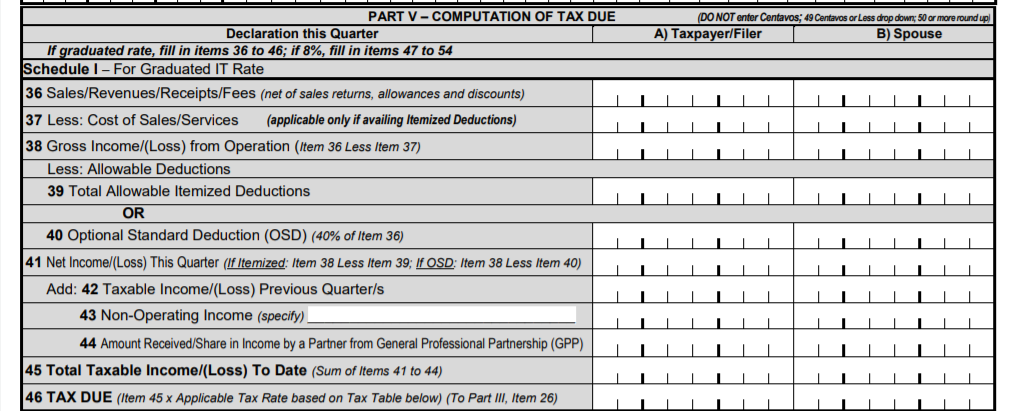

How To File Bir Form 1701q A Complete Guide For 2021

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return

Basic Guide To Corporate Income Tax For Companies

Did You Know Certain Tax Return Due Dates Changed This Year Preservation Family Wealth Protection Planning

Explained All About Belated Filing Of Income Tax Returns

:max_bytes(150000):strip_icc()/balance-tax-return1-8b74d7fde2b44e5baa394d2ceda7d730.jpg)

Federal Income Tax Deadlines In 2022

Estate And Gift Taxes 2020 2021 Here S What You Need To Know Wsj

2021 Taxes 8 Things To Know Now Charles Schwab

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

Ay 2020 21 Income Tax Deadlines Fy 2019 20 Itr Filing Last Date

Federal Income Tax Deadline In 2022 Smartasset

Did You Know Certain Tax Return Due Dates Changed This Year Preservation Family Wealth Protection Planning

Business Income Tax Malaysia Deadlines For 2021

When Are Taxes Due In 2022 Forbes Advisor

Irs Form 1040 Individual Income Tax Return 2022 Nerdwallet

Irs Form 1041 Filing Guide Us Income Tax Return For Estates Trusts

Iras Individuals Required To File Tax

Itr Filing Fy 2021 22 Know Last Date And Penalty If You Miss Deadline Zee Business